Hi Traders,

Apologies for missing the last two weeks on FX Tutors. I actually published 2 newsletters on ElliottWaves.com.au but my ITs messed it up badly. Similar faith had the new type of video-newsletter on YouTube. BTW, my newsletter will stay free although you may have to login to get it sometimes in the future.

Before getting into our usual analysis (today: EURUSD) let me remind you that:

FIRST: The WEDNESDAY FREE TRADING WEBINARS are still on. They are hosted by ELLIOTT WAVES & FX TUTORS and presented by Mario D. Conti.

Please register for the date and time that works best for you by clicking the link below: https://attendee.gotowebinar.com/rt/8514371004062869248

TOPIC: Each Wednesday we will give away precious SETUPS, ENTRY POINTS & TARGETS determined by means of a combination of Elliott Waves + Candlesticks + Fibonacci + Oscillators.

WHEN: Each Wednesday, 7:00 PM AEST (Sydney Time).

HOW LONG: 45 minutes

After registering, you will receive a confirmation email containing information about joining the webinar.

AUDIO: Participants can use their computer's microphone and speakers (VoIP) or telephone. Australia: Toll +61 3 8488 8992

Access Code: 508-768-150. Audio PIN: Shown after joining the webinar.

NOTE: Don't forget to RSVP on your Meetup and please, connect 5 minutes earlier.

SECOND: We are running a new ONLINE ELLIOTT WAVE TRADING COURSE.

This course will be held through GoToMeeting which allows everybody to interact through each session.

FEATURES

- Attendance: limited to 6 people

- Structure: 5 online sessions of 2 hours each

- first 3 sessions about

- Elliott Wave Theory

- Elliott Wave Labelling

- Shape, Amplitude and Extensions of waves

- Type of retracements

- New set of rules

- Candlestick Theory

- Identify Reversal Candlesticks and Pivot Points

- The "Wave Oscillator" and other Indicators to confirm Pivot Points

- Fibonacci Targets

- the other 2 Sessions: identifying Set Ups, Triggers, Entry points, Exit Points

- Price: $1,500 (GST included)

When:

- Monday, April 8, 7pm-9pm AEST (Sydney time)

- Tuesday, April 9, 7pm-9pm AEST (Sydney time)

- Thursday April 10, 7pm-9pm AEST (Sydney time)

then

- Monday April 22, 7pm-9pm AEST (Sydney time)

- Tuesday April 23, 7pm-9pm AEST (Sydney time)

To RSVP please EMAIL to info(at)FXTutors.com.au to receive instructions

ANALYSIS

SETUP on EURUSD, Tuesday March 26, 2013, (please read our disclaimer)

SITUATION

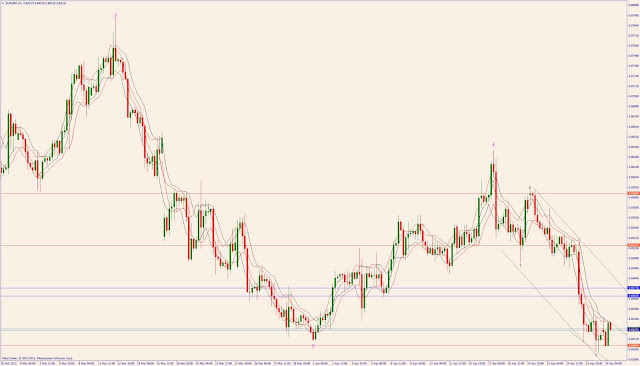

The Euro, now at 1.2864, is yet to complete a pattern of 5 waves down (numbered in magenta). This pattern constitutes the "major wave 4" and it's made of 5 waves. See the monthly chart below.

Although it went nicely through a set of 1-2-3-4 waves (in magenta), it didn't complete the last one yet which is unfolding with a 5-3-5.

More precisely, we have only a mere "5-3" out of a 5-3-5, where this "3" is usually called "2 step pattern".

After performing this "2 step pattern" (see monthly and weekly chart below) as I predicted months ago, the Euro resumed its way down and it is now heading to 1.19 and maybe to the area 1.120-1.065.

This will be possible with 5 waves down of a minor grade, the first of which seems to be completed.

Monthly chart: click to enlarge

NOTE: the "2 step pattern is the middle formation that links a 5-3-5 down or a 5-3-3".

In the weekly chart below, after point 4 (in magenta) we had 5 waves down followed by this "2 step pattern" which is always made of 3 waves.

This will be followed by some 5 waves down (occasionally, only 3)

Weekly chart: click to enlarge

SETUP: After the "2 step pattern" in parole the EUR completed the first of 5 waves down in the Daily Chart and it's ready to bounce back upwards to make wave 2 (in 3 waves up).

Trade: long

Likely target: 1.3040

Possible target: the area 1.3120-1.3134

Maybe: 1.3160

Please check the 1-hour chart: the EURO doesn't seem to be really convinced to rebound, meaning that there could be another attempt to reach 1.283-1.284. Just keep your eyes open.

Daily chart: click to enlarge

4-hour chart: click to enlarge

1-hour chart: click to enlarge