Hi Traders,

All according to plan? It looks like.

Still, be cautious as markets are getting jittery.

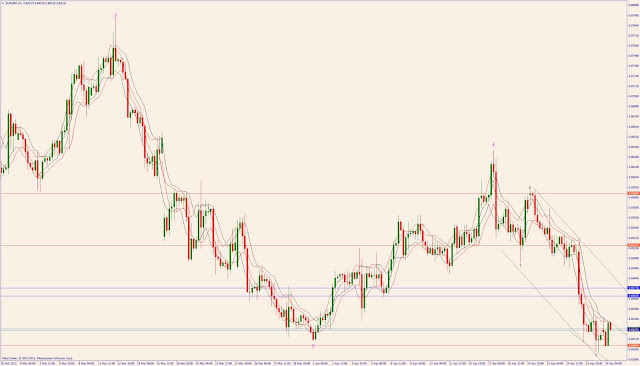

Last week I say that EURUSD was likely to bounce up to 1.31 before plunging. It dropped religiously (although it went further up to 1.32).

Now, if this analysis is correct, this should be the last chance to get quite a long trade down to 1.2512 - 1.2330 - 1.2120 - 1.1950 and below, unless the BCE intervenes to stop the slump (I doubt it).

Supports for the short term:

- 1.2891-1.2880-1.28738

TARGETS (short term)

likely: 1.2891 - 1.2878 - 1.28690

possible: the area 1.2779-1.2748

maybe: the area 1.2687-1.2668

Check some target the weekly chart right below

ELLIOTT WAVES

In the daily chart below, the EURUSD performed a large 5dwn-3up-5dwn-3up-5dwn downward to 1.2039. See point "55" at the bottom of the chart.

This wave was followed by a two-step-pattern (1up-2dwn-3up). See point "53" at the top of the chart.

This two-step-pattern should be followed by another large 5dwn-3up-5dwn-3up-5dwn. Wave 1 and 2 are already on the chart (in magenta).

Note: if this analysis is correct, this large wave down should be the very last chance to witness a large scale downtrend for the Euro, maybe for few years.

Similarly, in the 4-hour chart below, the EURUSD performed a 5-3-5-3-5 (5 waves downward) to 1.2745, followed by a two-step-pattern (1-2-3 up).

If this analysis is correct, the two-step-pattern will be followed by another 1-2-3-4-5 wave downwards of a lesser degree if compared to the daily chart.

Wave 1 and 2 are already on the chart. Wave 3 is not completed yet.